Success-stories

Real-Time Risk Detection at High Concurrency: How EasyCash Secures Growth with NebulaGraph Enterprise

About EasyCash

EasyCash is a leading Indonesian fintech platform that leverages AI, big data risk assessment models, and core credit systems to provide accessible, secure, and inclusive financial services for SMEs and individuals. As of July 2022, the platform has reached 11 million registered users and disbursed over $1 billion in loans to 2 million borrowers.

Business Challenges: Bottlenecks in Real-Time Fraud Detection

However, with rapid growth came complex operational challenges—especially when it came to fraud detection. Traditional relational databases struggled under the pressure of high-concurrency scenarios, often taking more than three seconds to return critical query results. This delay led to a 30% miss rate on high-risk applications, leaving gaps in the company’s defense against organized fraud rings. Static rule-based systems were also ineffective in detecting evolving tactics such as “one device, multiple accounts” or “one ID, multiple users,” where bad actors distributed fraudulent behavior to avoid detection.

Compounding these issues was the company’s offline data architecture, which required more than eight hours to generate graph-based features needed for machine learning models. This bottleneck severely limited the responsiveness of their AI-driven risk engine, making it difficult to deploy up-to-date fraud detection strategies in real time.

Solution: A Graph-Powered Risk Control Upgrade

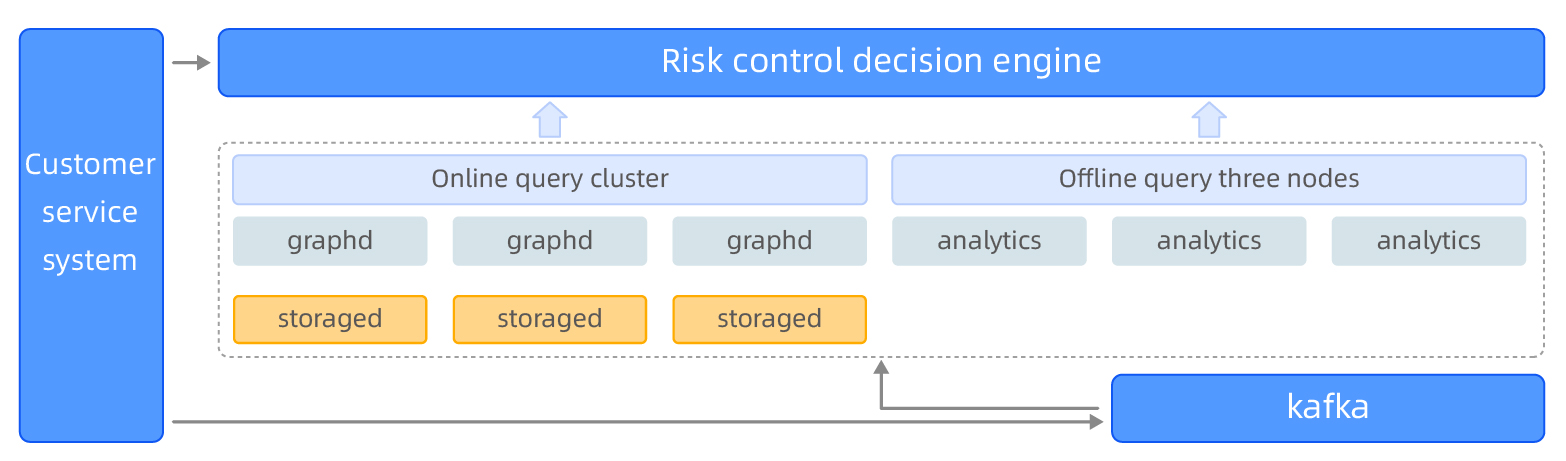

To overcome these limitations, EasyCash turned to NebulaGraph Enterprise , a distributed graph database trusted by leading enterprises for mission-critical workloads. By leveraging the power of graph technology, EasyCash built a real-time risk detection system capable of analyzing vast, interconnected datasets with low latency and high throughput.

At the core of the new system is a real-time risk graph containing over 1 billion nodes and 19 billion edges , dynamically updated with information about users, devices, phone numbers, emergency contacts, and binding relationships. Powered by NebulaGraph Enterprise , this infrastructure enables two key fraud detection workflows.

Credit Assessment: 8ms Decisions at Scale

In the credit assessment phase, when a user submits a loan application, the risk engine performs real-time queries into the user's 1–3 degree network. For example, it checks whether the applicant’s emergency contact appears on a blacklist or if the same device has been associated with more than five IDs. Based on dynamic graph rules, the system generates a risk score in under 8 milliseconds per query, even under 300+ concurrent requests.

Disbursement: Unmasking Hidden Networks

During the disbursement phase, EasyCash combines real-time graph features generated by NebulaGraph Enterprise —such as community risk density and fund flow paths—with machine learning models to detect complex fraud patterns. Using subgraph embedding techniques, the system uncovered a spider-web-like network involving 20 devices and 100 phone numbers, enabling precise interception of coordinated loan fraud attempts.

Why NebulaGraph Enterprise?

EasyCash chose NebulaGraph Enterprise for its proven ability to deliver high-performance, scalable, and reliable graph computing in production environments. Some key reasons behind EasyCash’s adoption include:

Distributed Architecture: Built from the ground up for horizontal scaling, NebulaGraph Enterprise allows organizations to grow their datasets seamlessly without compromising performance. Its multi-node architecture ensures high availability and fault tolerance.

High Concurrency & Low Latency: The system excels in high-throughput environments where thousands of queries must be processed simultaneously with minimal response time. This makes it ideal for real-time applications such as fraud detection engines.

Seamless Integration: NebulaGraph offers flexible connectors for Spark, Flink, Kafka, and other big data technologies, making it easy to integrate with existing data pipelines and machine learning workflows.

These features enabled EasyCash to build a unified, intelligent risk control platform that scales with business growth while maintaining responsiveness and accuracy.

Customer Value Delivered: Enhanced Fraud Detection and Operational Efficiency

As a result of this transformation, EasyCash saw measurable improvements across its operations. Risk screening was moved earlier in the process, allowing the company to intercept 60% of high-risk applications during the credit assessment stage, reducing manual review workload by 70%. Despite increasing the overall fraud interception rate by 240%, EasyCash achieved a 15% increase in user approval rates, demonstrating that strong security does not have to come at the cost of user experience.

With NebulaGraph Enterprise, EasyCash has built a robust, intelligent, and scalable risk control system—one that supports sustainable business growth while protecting users from increasingly sophisticated threats. Its automated approval system reduces traditional financing barriers by 40%, with an average loan processing time under 8 minutes, directly addressing Indonesia’s demand for efficient, transparent, and inclusive financial services.