Success-stories

A Global Fintech Unicorn Safeguards Financial Transactions with NebulaGraph

This global payments fintech unicorn offers a financial service interface for international transactions and global funds transfer for over 100,000 corporate entities over the world. This platform was established in 2015 and it serves as a hub for customers to receive payments from close to 180 countries and send money to over 150 countries, totaling over $50 billion in worldwide remittances as of January 2024.

Challenges: Upgrading Risk Control System Amid Rising Financial Fraud

The company used to leverage a conventional relational database for their risk control system, yet the relational database has restrictions on data model representation. Besides, it was inefficient in processing multiple-table joins, leading to failed identification of risk in fraud conduct within financial transactions.

The company well understands that a successful financial platform relies on not only its ability to facilitate seamless transactions but also its capacity to guard assets and transactions, particularly with today’s sophisticated financial scams. Upon retrospective analysis of the fraudulent incidents, the company found that graph databases outperforms relational ones in revealing hidden data correlations, making them an optimum solution for such scenarios.

The Solution: NebulaGraph Boosted Their Fraud Detection Capabilities

The company evaluated several enterprise graph database solutions, including ArangoDB, Neo4j, TuGraph and NebulaGraph with regard to architectures, performance, and scalability. The selection saw the choice of NebulaGraph because of its shard-nothing distributed approach, horizontal scalability as well as professional technical support.

- Global Compliance with Distributed Architecture Since the company operates globally, it is faced with many data compliance requests from various regional authorities such as anti-money laundering and consumer privacy protection. This requirement was met by NebulaGraph which has a shard-nothing distributed architecture design separating storage from computation.

- Superior Performance for Real-time Anti-fraud Detection An essential goal of the selection was to support real-time anti-fraud operations. In such a context, the underlying graph database must be able to handle over 1,000 concurrent requests and offer millisecond-level response times. NebulaGraph's powerful native graph engine enables lightning fast QPS and TPS with millisecond latency, handles high levels of concurrency, making it an excellent fit for the company’s needs.

- Seamless Scalability for Future Growth In consideration of the future expansion plans, the company laid emphasis on scalability. NebulaGraph provides robust horizontal scalability due to its shared-nothing distributed storage design. It was thus perceived as an ideal solution which could effectively handle their expanding business and data in the future.

- Premium Technical Support for Critical Infrastructure Stability is a must-have for any foundational software and the company needed the provider of graph databases to have reliable technical support in graph technology. NebulaGraph, the leader of the distributed graph databases, boasts a deep bench of top experts in the graph technology industry. Thus, their professional technical support capabilities have been highly praised by the company from the initial project engagement to the final rollout.

The Achievement: Secure Transactions through Risk Control Platform Built on NebulaGraph

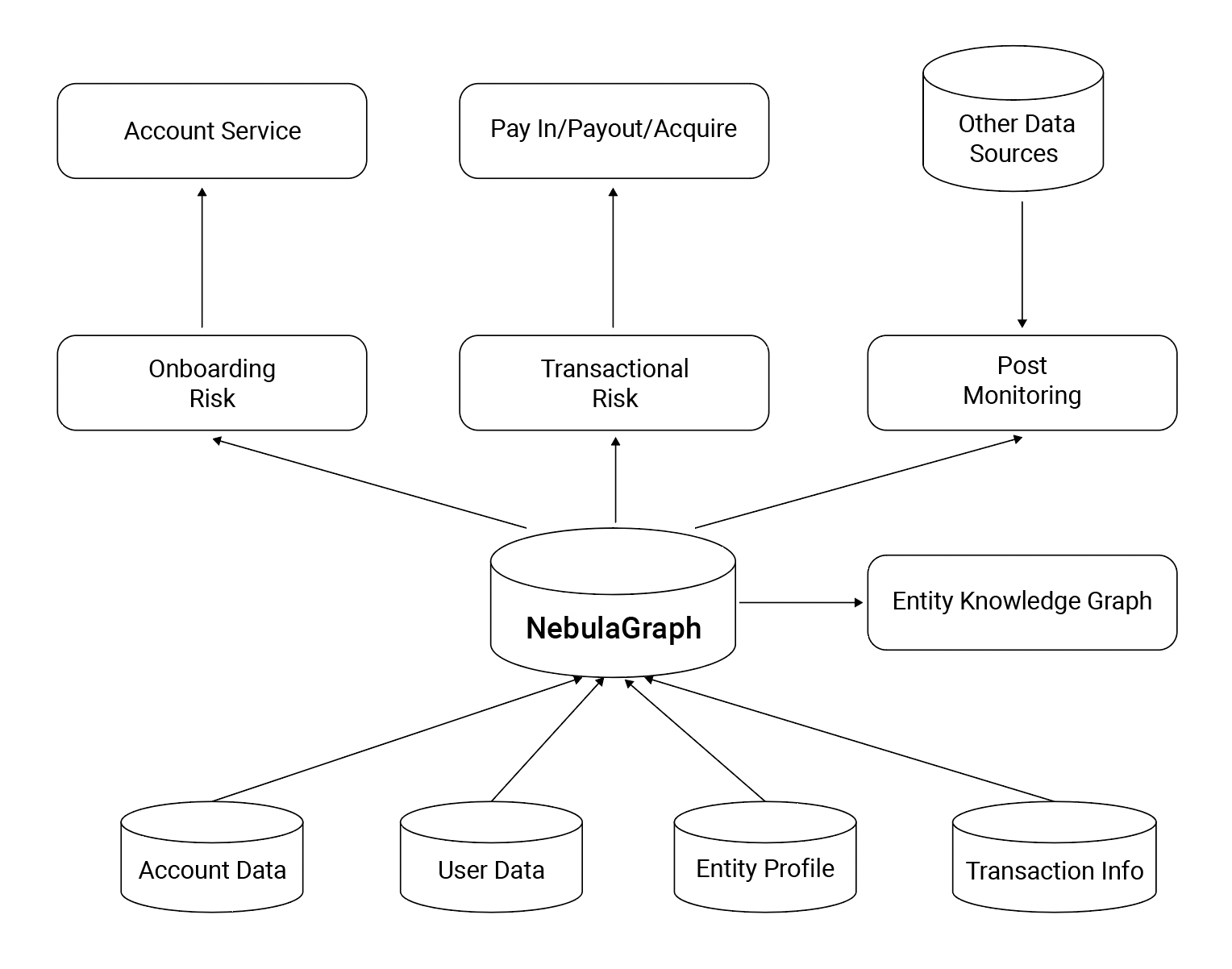

NebulaGraph plays a vital role in this entire risk control platform across three sub-domains namely Onboarding Evaluation, Transaction Risk Review and Post-Transaction Analysis, all aimed at guaranteeing safety of transactions made on the system.

- Onboarding Evaluation: NebulaGraph is used by the company to analyze the potential relationships between new users’ network information, device fingerprints, and user profiles. Through a complete review of all this, it automatically filters out those with some high-risk connections.

Transaction Risk Review: The system reviews each occurring transaction carefully based on a model of risk assessment. When transactions have been flagged for suspicion and necessitate manual review, NebulaGraph can be used to conduct detailed association analysis of both the transaction entity and its counterparty. This capability significantly aids their audit personnel in making informed decisions.

Post-Transaction Analysis: Historical behavior of company clients is periodically scanned using data mining and machine learning techniques to detect unusual users or transactions. With NebulaGraph’s native support towards graph clustering algorithms, clusters of connected accounts can be identified very effectively. Such suspicious account clusters could be homogeneously labeled as well as discovered thereby being subjected to comprehensive manual scrutiny in order to mitigate future risks.

In addition to contributing to the risk control platform, NebulaGraph has been responsible for creating a holistic user knowledge graph for the company. This graph acts as an information base for RAG and assists by giving out short summaries of customer firms’ equity, operational status and partner data through LLM in the most user-friendly manner. These summaries are important points of reference for compliance departments that facilitate quick comprehension of their different businesses operating conditions.

In summary, NebulaGraph has played an essential role in the company’s pursuit to establish a secure, efficient and reliable financial system. Through its capacity of analyzing complex interactions and behaviors, it has enabled the firm to mitigate risks at all stages of users journey from on-boarding up to post event analysis.